Contents:

In truth, it’s just as complex and competitive as any other world marketplace. To not only succeed but also succeed consistently, you need to understand the market and hone your trading strategy. Technical indicators generally are not part of a price action strategy, but if they are incorporated they should not play a large role in it, but rather be used as a supporting tool. Some traders like to incorporate simple indicators such as moving averages as they can help identify the trend. Most successful forex traders develop a strategy and perfect it over time.

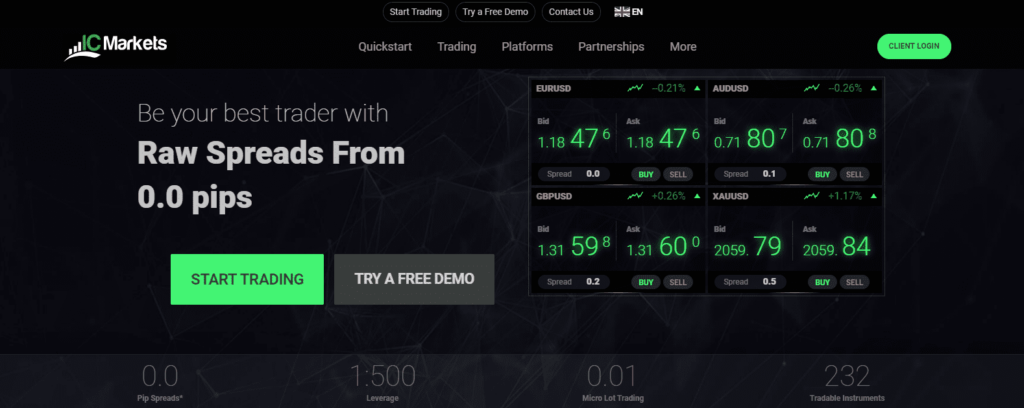

Day trading carries less risk than other strategies, thanks to the ability to set a narrow Stop Loss. Usually, scalpers prefer to trade the most liquid Forex pairs like EURUSD or USDJPY. If you want to try scalping, you should find a broker with low spreads and fast order execution. Opening a trade before researching the market is not what you want to do. The prices of different currencies might depend on completely unrelated factors because they are governed by different banks, institutions, and market conditions.

https://trading-market.org/ traders hold positions for several weeks, months, and even years in some cases. The aim of this Forex trading technique is to identify a market trend, buy into it, and sell out when the trend reaches its peak. Forex scalping, day trading, swing trading, and position trading are four popular Forex trading techniques that have proven to be successful in 2022. They differ by the typical time involved, ranging from short-term to long-term. Forex is the largest and most liquid financial market in the world, with a daily trading volume of about $6.6 trillion.

Trend trading strategy

In our example below, the blue line is the fast EMA, set to a nine-day period, while the red line is the slow EMA – set to a 14-day. The first candlestick that touches the EMA is called the ‘signal candle’, while the second candle that moves away from the EMA again is the ‘confirmatory candle’. Traders would place their open orders at this price level to take advantage of the rebounding price.

- A breakout trading strategy is one of the more common types of day trading, where trades get triggered if an asset’s price moves above a predetermined level.

- A popular example is going long AUD/JPY (due to Australia´s historically high and Japan´s historically low interest rates).

- The MACD is a momentum indicator that plots the difference between two trend-following indicators or moving averages.

- A forex trading strategy is a technique used by a forex trader to determine whether to buy or sell a currency pair at any given time.

- You open a buy position, when the price reaches or exceeds the local high of the volume candlestick .

Its purpose is to reveal when the trend is most likely to reverse. Day trading is the practice of making short-term trades on the same day. Typically, positions last for a few hours and are not left open overnight.

Find out what Influences Currency Prices 💵

In this case, the pattern is a single candlestick in the price chart. It is the candlestick that has no or a very short body and very long shadows. It is because when it emerges, there are huge trading volumes, clashing in the market.

Trend trading strategies involve identifying trade opportunities in the direction of the trend. The idea behind it is that the trading instrument will continue to move in the same direction as it is currently trending . A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Depending on your level of expertise and amount of capital, there are several standard trading sizes for forex accounts.

https://forexaggregator.com/ trading is when you follow the news for several countries and play the countries with strengthening economic trends, against the ones with weakening economic trends. This type of approach is pretty easy because it looks at how things shape up over the long term. The complicated portion of it is learning to understand the economic reports and compare them to other countries. Day trading is appropriate for more experienced investors and uses forex technical analysis to decide which trades to make. Position trading is reserved for more patient traders with a background in finance and economics as they look to profit from long-term market trends. Successful trading strategies require you to know your risk sentiment.

Daily Fibonacci Pivot Trade

I will look at all your inside bar price action data again along with other important data that is germane. “Inside bar” is the price action that I have been studying and now with some renewed vigor. … and when Tiger’s ex divorced him, it illustrated perfectly that you lose money when you get distracted. What do most people that make a lot of money in this world have in common? At first you might say “nothing” besides the fact that they all make a lot of money. But what is the fundamental reason, behind all else, that these people and others like them make so much money while the rest of the world struggles to get themselves out of bed in the morning?

Maximizing Profits with Forex Prop Firms – Traders Union advices – Net Newsledger

Maximizing Profits with Forex Prop Firms – Traders Union advices.

Posted: Wed, 01 Mar 2023 09:14:39 GMT [source]

You want a brokerage that offers what you need, is safe, has a great trading platform, and most of all—dirt cheap. Some of the top forex brokers in the US, as well as many top UK brokerages, fit that description perfectly. This means borrowing one currency at a low rate and then investing in another currency that provides a higher rate. Doing this will produce a positive carry on the trade—hence the name.

Popular Forex Trading Strategies For Successful Traders

Into their https://forexarena.net/, which leads to information overload and conflicting signals. You can always tweak your strategy as you go and use the experience you learnt from backtesting and demo trading. One way to learn to trade forex is to open up a demo account and try it out. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

Overall, the forex trading strategy defines how you will approach the markets, and eventually, dictate the entry and exit points you take based on the market environment. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider.

Manual testing is slow and can be rather inaccurate, but requires no extra programming and can be done without any special preparation process. Any backtesting results should be taken with a grain of salt as the tested strategy might have been created to fit particular backetsting historical data. However, brokers often won’t tell you everything you need to know and this is where problems arise.

Together, these support and resistance levels create a bracketed trading range. Trend trading doesn’t require traders to know what will happen next—only to understand what is happening right now. To trade effectively, however, it’s important to confirm the direction and strength of a new trend before entering into a position. Although you may not be the first one to enter the trade, being patient will ultimately shield you from unnecessary risk.

From this data, they can see recent price movements of a currency pair, and other helpful information to help you make good investment decisions. With a day trading forex strategy, traders work within one trading day, closing out positions at the end of each day as a sort of risk management. Thus, this can protect traders from price movements that may occur overnight when they’re not monitoring price action and trends. Similar to analysing support levels, forex traders also analyse resistance levels.

The choice of the risk-reward trade-off strongly depends on trader’s risk preferences. Often the performance is measured against a benchmark, the most common one is an Exchange-traded fund on a stock index. In the long term a strategy that acts according to Kelly criterion beats any other strategy. However, Kelly’s approach was heavily criticized by Paul Samuelson. Day Trading; The Day trading is done by professional traders; the day trading is the method of buying or selling within the same day.

In its simplest form, moving average crossovers are the fastest ways to identify new trends. Like any other investment arena, the forex market has its own unique characteristics. In order to trade it profitably, a trader must learn these characteristics through time, practice, and study. Here are the secrets to winning forex trading that will enable you to master the complexities of the forex market. In a similar vein, not every strategy is well-suited to every market.

To shoulder less risk, traders should wait to enter into a new position until the price reversal can be confirmed. They rely on analytical data to identify trending markets and determine ideal entry and exit points therein. They also conduct a fundamental analysis to identify micro- and macroeconomic conditions that may influence the market and value of the asset in question.