Contents:

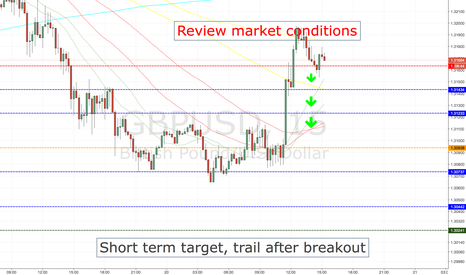

The actual return can be quite different from the yield to maturity because the market can turn around anytime. We also assume that all coupons are reinvested in the bond at the same coupon, which might not be possible or viable since the price may fluctuate. Primarily, yield to maturity helps to draw a comparison between bonds or debt mutual funds on the basis of their expected returns. It also helps investors to understand how changes in the market conditions, with the rise and fall of interest rates, affect their debt portfolio as well. The Capital market where companies or governments directly issue securities (debt-based or equity-based) to raise funds is called Primary Market. In the primary market, the issuer sells securities at predetermined prices.

So you are surely surprised to hear about call and put options on bonds. As you are aware a bond or debenture is a fixed return instrument which pays regular interest and then redeems the principle at the end of the tenure of the bond. You know about differences between call options and put options in indices and equity trading; but what is meant by call and options on bonds? Is this the same as buying put options and writing call options on equities and indices? The yield spread is the difference between yields of two bonds issued by the same or different issuer and may come with varying maturity, credit rating, and risk. The yield spread is calculated and expressed in percentage or basis points.

Open your FREE Demat Account in 5 Minutes

A security issued by a company in which the company acknowledges that a stated sum is owed and will be repaid at a certain date. A corporate bond, like a government-issued bond, usually pays a stipulated amount of interest throughout its life to the holder. The Coupon or Coupon rate is the rate of interest paid by fixed-interest security such as Bond/ Debenture. The issuer can redeem these bonds early on the happening of a particular event.

Yes, https://1investing.in/ bonds are a good buy for investors willing to take some risk in the fixed income asset class. This is because corporate bonds are considered to be riskier than government bonds. Simply put, corporate bonds offer higher returns than government bonds but are slightly riskier too.

Yield For Bonds:

However, the financial market features a vast array of securities, like a callable bond. Any individual newly stepping into the market can find it perplexing, which further undermines their capacity to undertake proper investment decisions. Hence, it is essential to educate oneself in the ways of such securities.

- Information on this Website sourced from experts or third party service providers, which may also include reference to any ABCL Affiliate.

- Hence, liquidity or trading in bonds is restricted compared to shares.

- The Website does not assume responsibility for the timeliness, deletion, mis-delivery, or failure to store any user data, communications, or personalization settings.

- The coupon income from the debt portion will stabilize the risky returns from the equity component.

- However, these securities are subject to only one type of risk i.e., interest-rate risk.

In recent years, investment in securities has gained tremendous ground among laypersons. This positive development in investor confidence can be attributed to newer, coming-of-age digital platforms making investments easier. Options like mutual funds are gaining currency rapidly, allowing individuals to utilise their excess income in financially fruitful ways.

Consequences of Misunderstanding a financial term

All secondary market transactions on stock exchanges have to be conducted through registered brokers. Sub-brokers help in reaching the services of brokers to a larger number of investors. Several brokers provide research, analysis and recommendations about securities to buy and sell, to their investors. Brokers may also enable screen-based electronic trading of securities for their investors, or support investor orders over phone. For bonds and, in extension, debt mutual funds, yield is known as normal yield. Yield, Coupon, and Yield to Maturity are parameters that an investor uses to compare different investment options.

Units are issued directly to investors when the scheme is launched. Equity Linked Savings Schemes are equity funds that provide tax benefits in the form of deductions under section 80 for the amount invested. As closed-end funds these schemes are listed on stock exchanges where they may be traded at prices related to the NAV. SEBI has codified and notified regulations that cover all activities and intermediaries in the securities markets. Local governments and municipalities may also issue debt securities to meet their development needs.

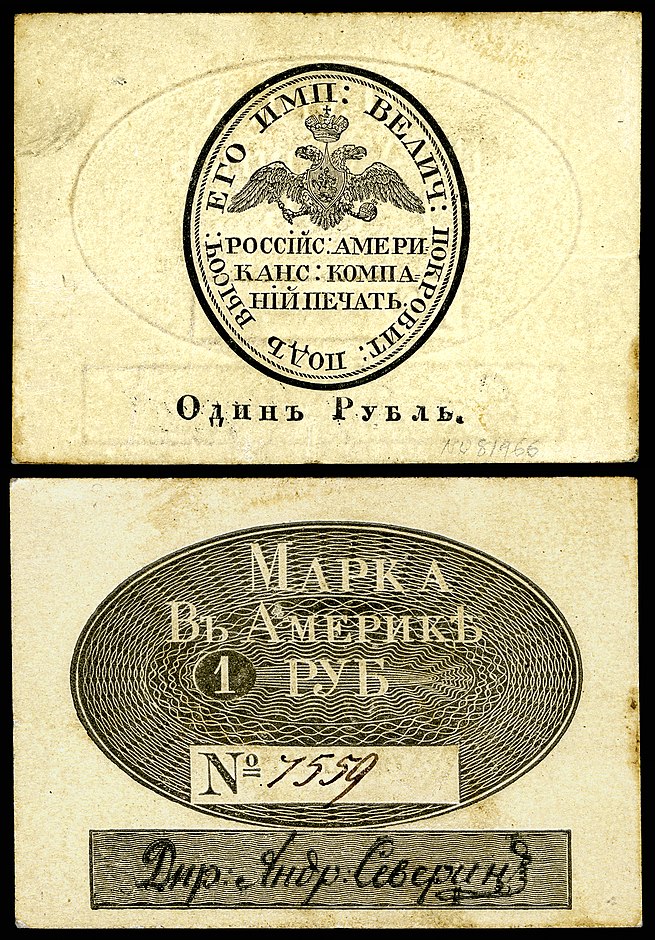

This means that he will get Rs 12,000 per year for 10 years until maturity. Let us now move ahead and understand the effect of price fluctuations and how to invest in bonds through the secondary market. Centuries ago, a bond used to look like this beautifully carved stone. Today, bonds are the primary source of funding for government and corporations. FRBs or Floating Rate Bonds comes with a coupon floater, which is usually a margin over and above a benchmark rate.

Floating rate bonds are also known as variable rate bonds and adjustable rate bonds. If you are a Financial Advisor, then it is extremely important to stay updated on the latest financial terms. We at IndianMoney.com update all the new terms used in personal finance in the Financial Dictionary. You can refer and update yourself, to serve clients effectively. This is a double bonanza of increasing your efficiency and fetching clients more money. Professional fund managers have more experience than the average investor.

What Does It Mean When a Bond Has a Sinking Fund? – Investopedia

What Does It Mean When a Bond Has a Sinking Fund?.

Posted: Tue, 28 Aug 2018 22:31:51 GMT [source]

These are sold directly by the callable bond definitions to the investors or else placed by borrowers through agents / brokers etc. These bonds are typically bought to mitigate the damaging effect of inflation on coupon payments and their face value. The principal amount is adjusted based on the inflation rate and interest is given out on the adjusted principal amount. This type of bond, unlike other bonds, yields interest payment and face value at maturity but can be converted into stocks of the issuing company at a certain time during the bond’s life. Fixed-rate bonds are the bond type that pays a bondholder a fixed amount of interest until the maturity of the bond. The bondholder under Fixed-rate bonds earns guaranteed income irrespective of the market conditions and the finances of the issuer.

YTC means the markets assume that the bond will forcibly be called back on the specified call date. The investor in a callable bond, on the other hand, loses the opportunity to stay invested in a high coupon bond if the issuer utilizes the call option. Typically, as callable bonds are known to deliver a higher interest or coupon rate to the investors, the companies issuing the same can look forward to benefitting from the same. In case the interest rates in the market fall after the floating of a bond by a corporation, then the company can go forward with issuing a new debt.

The large size of contract value makes it conducive only for banks and large institutions to trade them. Retirees or senior citizens can hold 50% of their portfolio in bonds. Bonds provide you both interest income and capital appreciation. However, both these incomes have different tax implications. If you buy a bond from the secondary market at a premium, then your YTM will be less. The interest earned on tax-free bonds is exempt per section 10 of the Income Tax Act of India, 1961.

- Return refers to the benefit the investor will receive from investing in the security.

- A corporate bond, like a government-issued bond, usually pays a stipulated amount of interest throughout its life to the holder.

- Yield to Maturity measures the current value of all future coupons of the bond by reinvesting all the coupon payments in the same bond.

- Commercial Papers are issued in the form of discount to the face value.

- International funds invest in securities listed on markets outside India.

However, investors can also choose not to exercise this option. For instance, if the interest rate rises, then a puttable bond can be redeemed. This will allow the investor to receive the principal amount. The investor can use this principal amount to invest in new bonds with a higher interest rate. Factors like financial objectives, risk tolerance, investment horizons and liquidity needs vary across investors.